Single-family housing starts in January were at a rate of 926,000, according to new data from the U.S. Census Bureau and the Department of Housing and Urban Development.

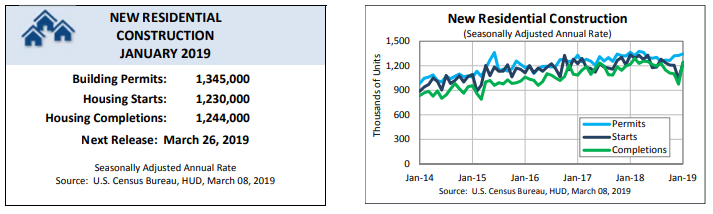

This is 25.1 percent above the revised December figure of 740,000. Privately-owned housing starts in January were at a seasonally-adjusted annual rate of 1,230,000, an 18.6 percent increase from the revised December estimate of 1,037,000 but a 7.8 percent drop from below the January 2018 rate of 1,334,000.

Single-family authorizations in January were at a rate of 812,000, down 2.1 percent from the revised December figure of 829,000.

Privately-owned housing units authorized by building permits in January were at a seasonally-adjusted annual rate of 1,345,000, up 1.4 percent from the revised December rate of 1,326,000 but down 1.5 percent from the January 2018 rate of 1,366,000.

Single-family housing completions in January were at a rate of 914,000, a 30.2 percent increase from the revised December rate of 702,000.

Privately-owned housing completions in January were at a seasonally-adjusted annual rate of 1,244,000, up 27.6 percent from the revised December estimate of 975,000 and 2.1 percent higher than above the January 2018 rate of 1,218,000.

“The data on new housing starts has been particularly volatile over the past few months, driven by large swings in multifamily starts,” said Mike Fratantoni, Senior Vice President and Chief Economist at the Mortgage Bankers Association.

“Focusing on the single-family data, the 4.5 percent year-over-year gain is a promising sign for the housing market. Given the underlying strength in overall housing demand, slow and steady growth in new supply will support a modest increase in sales.”

Courtesy: Phil Hall, National Mortgage Professional Magazine.