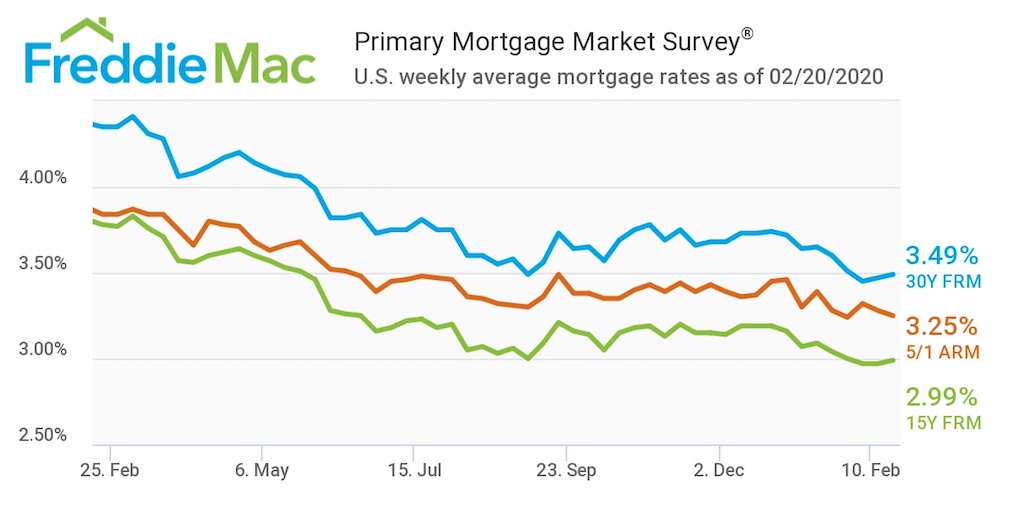

The average U.S. fixed rate for a 30-year mortgage ticked up to 3.49% this week, rising slightly from last week’s rate of 3.47%.

This week’s rate is only two basis points above the previous week’s rate, but a whopping 86 basis points below the 4.35% of the same week last year, according to Freddie Mac.

Sam Khater, Freddie Mac’s chief economist, said the nation’s low mortgage rates continue to champion this year’s purchasing demand.

“The low mortgage rate environment continues to spur homebuying activity, with applications to purchase a home up 15% from a year ago,” Khater said.

“We’ve seen new residential construction surge over the last few months, on pace to reach the highest level in more than a decade. This is a good sign for the inventory-starved housing market and is a promising indication for the spring home buying season.”

According to the survey, the 15-year FRM averaged 2.99% this week, crawling forward from last week’s rate of 2.97%. This time last year, the 15-year FRM came in at 3.78%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.25% this week, falling from last week’s rate of 3.28%. Last year, the 5-year ARM averaged 3.84%.

The image below highlights this week’s changes: